Some Known Details About Estate Planning Attorney

Some Known Details About Estate Planning Attorney

Blog Article

Estate Planning Attorney Can Be Fun For Everyone

Table of ContentsAn Unbiased View of Estate Planning AttorneyThe Main Principles Of Estate Planning Attorney How Estate Planning Attorney can Save You Time, Stress, and Money.Estate Planning Attorney Can Be Fun For Anyone

Your attorney will certainly also assist you make your records official, scheduling witnesses and notary public trademarks as required, so you do not have to fret about attempting to do that last action on your very own - Estate Planning Attorney. Last, but not least, there is important satisfaction in establishing a partnership with an estate preparation attorney that can be there for you later onBasically, estate planning lawyers provide worth in many methods, much beyond just giving you with published wills, trust funds, or other estate intending papers. If you have concerns concerning the process and want to discover more, call our workplace today.

An estate preparation lawyer aids you formalize end-of-life decisions and legal files. They can establish wills, develop trusts, produce healthcare regulations, establish power of lawyer, create succession plans, and extra, according to your desires. Dealing with an estate preparation lawyer to complete and manage this legal documents can assist you in the adhering to eight areas: Estate planning attorneys are experts in your state's trust, probate, and tax obligation laws.

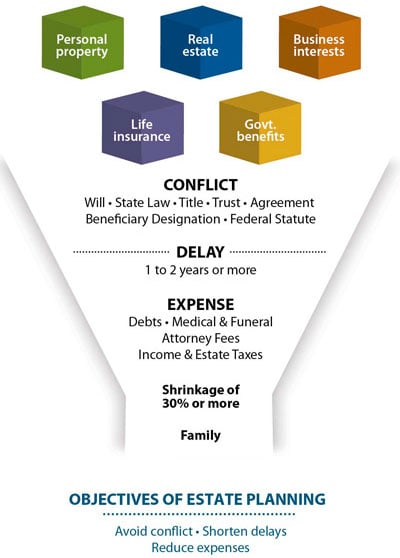

If you do not have a will, the state can make a decision exactly how to separate your properties among your heirs, which might not be according to your desires. An estate planning attorney can help organize all your legal records and distribute your properties as you wish, potentially staying clear of probate.

All about Estate Planning Attorney

Once a customer passes away, an estate strategy would certainly determine the dispersal of assets per the deceased's directions. Estate Planning Attorney. Without an estate plan, these choices might be entrusted to the next of kin or the state. Duties of estate organizers consist of: Developing a last will and testimony Setting up depend on accounts Naming an executor and power of lawyers Determining all recipients Calling a guardian for small children Paying all financial debts and reducing all taxes and lawful charges Crafting instructions for passing your worths Establishing preferences for funeral plans Finalizing guidelines for care if you become unwell and are not able to make decisions Getting life insurance, disability revenue insurance policy, and long-lasting treatment insurance A good estate strategy must be upgraded on a regular basis as customers' monetary circumstances, individual motivations, and federal and state regulations all evolve

Just like any kind of career, there are qualities and abilities that can aid you attain these objectives as you work with your customers in an estate organizer role. An estate planning career can be best for you if you have the adhering to attributes: Being an estate coordinator suggests believing in the lengthy term.

All about Estate Planning Attorney

You must assist your customer expect his or her end of life and what will certainly occur postmortem, while at the very same time not house on morbid ideas or emotions. Some customers might come to be bitter or troubled when contemplating fatality and it might be up to you to read the full info here help them via it.

In the occasion of death, you may be anticipated to have countless conversations and negotiations with surviving household participants regarding the estate plan. In order to succeed as look at this web-site an estate coordinator, you might require to stroll a fine line of being a shoulder to lean on and the individual depended on to interact estate preparation issues in a timely and specialist way.

Expect that it has Learn More Here been changed even more since then. Depending on your customer's financial revenue bracket, which may develop toward end-of-life, you as an estate planner will certainly have to maintain your customer's possessions in complete lawful conformity with any kind of neighborhood, government, or global tax obligation legislations.

The Basic Principles Of Estate Planning Attorney

Gaining this qualification from organizations like the National Institute of Licensed Estate Planners, Inc. can be a strong differentiator. Being a member of these specialist teams can verify your skills, making you extra attractive in the eyes of a potential customer. In enhancement to the emotional reward helpful clients with end-of-life preparation, estate planners appreciate the advantages of a stable revenue.

Estate preparation is a smart thing to do no matter of your present wellness and financial standing. Not so many individuals recognize where to start the procedure. The very first vital thing is to work with an estate planning lawyer to assist you with it. The complying with are five advantages of working with an estate preparation lawyer.

An experienced lawyer understands what details to consist of in the will, including your beneficiaries and unique factors to consider. It likewise offers the swiftest and most reliable approach to move your assets to your recipients.

Report this page